Pix Automatico

NewPix Automatico offers consumers an effortless and cost-effective way to manage recurring payments, by enabling seamless cross-regional recurring transactions.

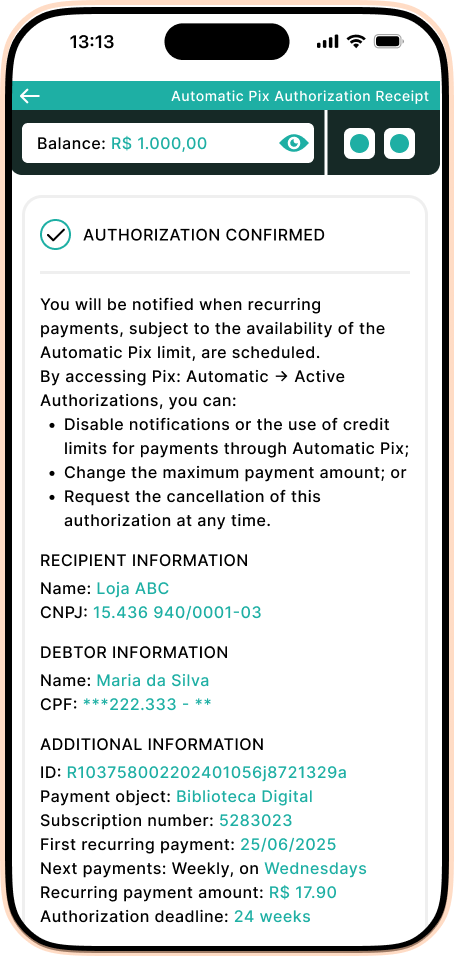

Developed by the Central Bank of Brazil, allows consumers to authorise recurring payments such as subscriptions, utilities, and membership with a single upfront consent. This eliminates the need for manual approvals with each transaction, reducing friction and improving retention in the payment journey.

Nowadays, 174 million people use Pix. From January 2024 to January 2025, Pix processed BRL 2.4 trillion — a 40% increase compared to the same period the previous year.

Want to integrate Pix Automatico onto your platform?

Get in touchPix

Pix is a Brazilian bank-transfer payment method, created in 2020 by the Central Bank of Brazil. Described as revolutionary, it enables any citizen with a deposit, savings, or prepaid payment account to make payments and transfers in a few seconds, at any time, 365 days a year. 750 institutions with over 500,000 active customer accounts – must participate. Within 15 months the Central Bank of Brazil reported that over 12.4 billion transactions had been carried out and 9.1 million companies had signed up. By April 2022 Pix accounted for 11.5% of all e-commerce payments in Brazil (Neotrust).

Want to integrate Pix onto your platform?

Get in touchWhy Pix Automatico

Massive adoption – Over 174 million Brazilians (out of 210 million) already use Pix, making it the most widely adopted payment method in the country.

Financial inclusion – Pix Automatico unlocks access for ~60 million Brazilians without credit cards, enabling them to pay for subscription services for the first time.

Frictionless experience – With instant confirmation and no need to re-authorize payments, Pix Automatico provides a seamless, secure, and efficient recurring payment experience — benefiting both consumers and businesses.

Payment flow

Want to integrate Pix Automatico onto your platform?

Get in touchWhy Pix

More than 127 million Brazilians, and 10 million businesses, use the payments platform (Bloomberg).

By the end of 2022, Pix was processing almost three billion payments a month with e-commerce accounting for 22% of all transactions (Central Bank of Brazil).

Within 6 months of launch, 83% of Brazilians considered Pix to be better than DOC and TED (types of electronic transfer) and 67% want to use Pix for payments in retail (C6 Bank/Ipec).